How to Catch Billing Mistakes Using Your Explanation of Benefits

After a visit to your doctor, you probably received a document from your insurer called an explanation of benefits (EOB). You can often identify this document because it will say, “This is not a bill,” on the envelope. Your EOB explains what your insurance is paying for, and it could help you catch billing mistakes made by your medical provider.

Understanding your health insurance coverage can be confusing. With terms like “premiums,” “deductibles,” and “copays” being tossed at you, it’s easy to get overwhelmed. However, the more you know about your insurance coverage, the better you can understand how much your treatments, office visits, medications, and services cost and when you might be getting overcharged. For a quick refresher on the key insurance terms, check out our Insurance Glossary.

What is an explanation of benefits (EOB)?

If you do not have health insurance, your healthcare provider will charge you for the visit. However, if you have insurance, the medical office will send the bill (or claim) to your insurance company for payment for those services. Your insurance company then determines what portion of this bill is covered by your plan and then sends you a document called an “explanation of benefits” (EOB) for your records. (You can also access the EOB on the insurance company’s website). You might recognize this as the letter that says, “This is not a bill,” on it. After your insurance pays its share, the office will send you a bill for any remaining amount.

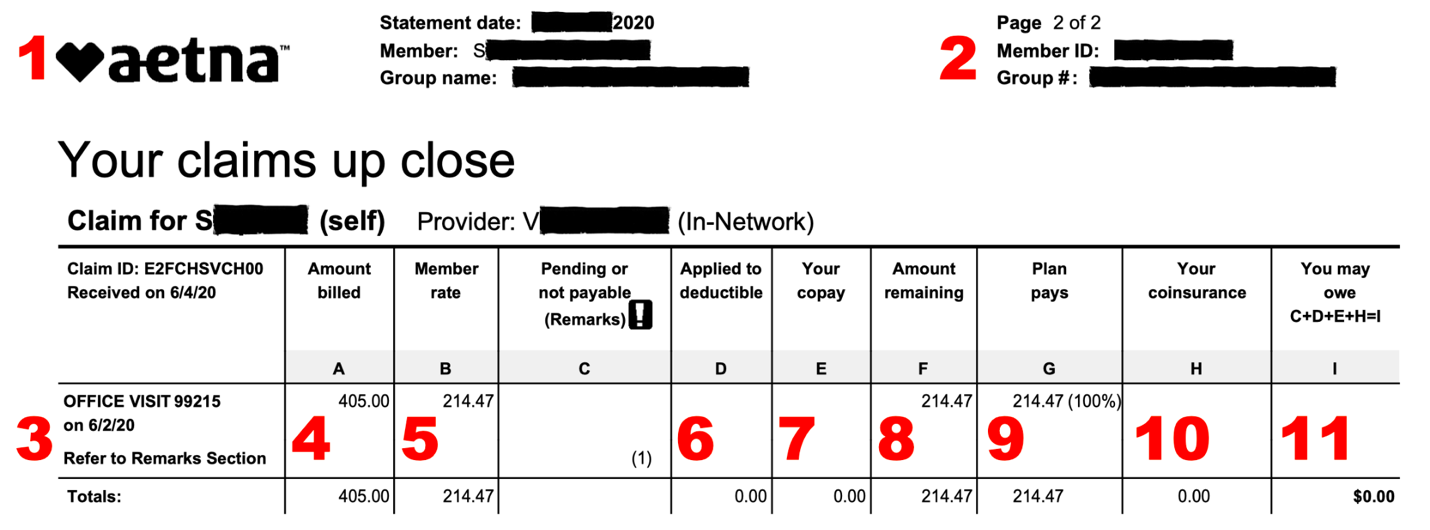

Let’s take a look at an actual EOB from Stephen, a member of the diaTribe community, from a visit he had with his endocrinologist. [Last name isn’t shared for privacy reasons.]

We broke down Stephen’s EOB into eleven sections that make it easier to follow along:

-

The top left corner is where you would find the name of your healthcare insurance provider. In Stephen’s case, it’s Aetna.

-

This is where you can find your Member ID and Group #, two numbers associated with your coverage that you will need when a new healthcare provider asks for your insurance information. These numbers can also be found on your insurance card.

-

The first column is where you will find what services were provided during your visit – this could be a general office visit, specific lab tests, or continuous glucose monitor (CGM) data analysis, among other things. In Stephen’s case, it looks like his endocrinologist billed only for the office visit.

-

This charge is known as the “Amount billed.” This is where you can see what your provider billed for a certain procedure or service. In Stephen’s case, his endocrinologist billed his healthcare insurance company $405 for his visit.

-

The “Member rate” is how much you have to pay for a certain procedure if you have health insurance. Since Stephen has health insurance, he gets this discounted rate of $214.47 based on negotiations done by his insurer.

-

If you have not yet met your deductible, you may have to pay a certain amount for this service toward your deductible. In this case, Stephen has already met his deductible and does not have to pay anything out of pocket toward that amount.

-

For some procedures and services, you may also have a copay, which is a fixed amount based on the service provided. In this case, Stephen did not have to pay a copay for this visit.

-

The “Amount remaining” is how much of the bill is left after the deductible and copay are subtracted. The insurer would pay all or some of this amount.

-

The “Plan pays” is how much of the remaining amount your health insurance covered. In Stephen’s case, his health insurance covered 100% of the remaining charges.

-

With certain insurance plans, you may also have what is known as a coinsurance, which is a certain percentage of the remaining amount that you are expected to pay.

-

This final section is what you are responsible for paying after all of the insurance calculations have been done. This is the amount you should expect to be billed for by your healthcare provider. In Stephen’s case, he is fortunate since it does not look like he will have to pay anything out of pocket, as his insurance paid for the entire visit.

Stephen said that since EOBs are available online from nearly every insurer, you can check them there in case you do not have access to a physical copy when the bill arrives.

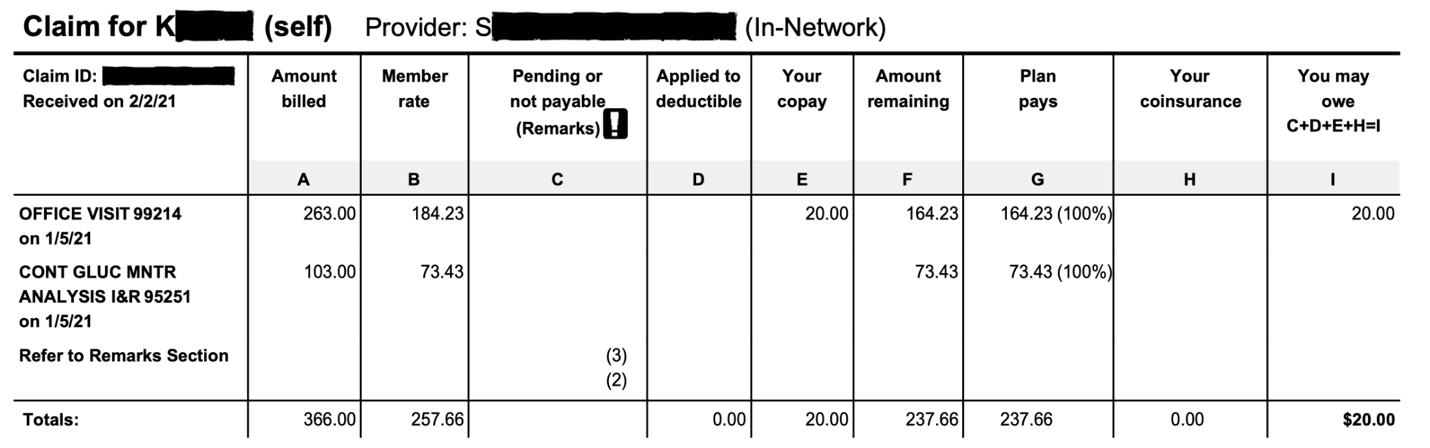

Let’s take a look at a second EOB from another diaTribe community member, Kylene. [Last name isn’t shared for privacy reasons.]

You can see that Kylene’s EOB is very similar to Stephen’s but has a few important differences. First, we can see that Kylene’s endocrinologist billed her for analyzing her CGM data, separately from the office visit. In addition, Kylene had to pay a $20 copay for her office visit, so her total came out to $20.

How can you use your EOB to catch billing mistakes?

Even though your EOB is not a bill, it’s useful to keep since the amount that your EOB says you are responsible for paying should match the amount that you were billed by your healthcare provider. If you notice a discrepancy between these two amounts, you may have caught a billing error.

“If the doctor’s office sends you a bill before the EOB is available, it is generally prudent to wait until you receive the EOB before you pay the bill. Otherwise, you may end up paying more than you owe,” said Dr. Charles Alexander, an endocrinologist with over 35 years of experience in diabetes care and research.

Stephen recommended you pay particular attention to your EOBs when receiving any care that is out of the ordinary. For example, Stephen once had an emergency appendectomy and had to coordinate bills from several different providers, including surgeons and anesthesiologists. Looking over his EOB helped him make sure he wasn’t paying a bill for anything his insurance was supposed to cover. Another time Stephen caught a billing mistake during a routine yearly eye exam. With a call to the clinic, he was able to sort out the issue.

Research from Becker’s Hospital Review, a leading publication on the business of healthcare, shows that up to 80% of all medical bills may contain mistakes, often from human error. Your provider might have made a typo when preparing your bill or accidently billed you twice for one procedure. These situations can be frustrating, but fortunately, there are several steps you can take to resolve these billing problems:

-

You can request an “itemized bill” from the billing department of your healthcare provider. This bill will provide a line-by-line explanation of each charge. You can cross reference this itemized bill with your explanation of benefits to see exactly where the mistakes may have occurred. Sometimes, these itemized bills can be dense and difficult to decipher. You should know that you have the right to ask someone at the billing department to walk you through each service on your itemized bill. Simple billing mistakes, such as double billing, can be quickly resolved in this way.

-

If the problem can’t be resolved by the clinic’s billing office because your insurance denied coverage for a certain treatment, you can file an appeal by asking your insurer to reconsider its decision. Since more than half of these appeals succeed, it may be worth your time. If you would like to learn more, check out our article, “When Insurance Gets Turned Down: Appeals Explained.”

Managing diabetes in the United States can be expensive – $16,752 per year on average, according to a 2018 study. We know that this varies widely and is very hard on people who have insurance only with a high deductible and high co-pays or those with no insurance. When every dollar counts, ignoring your EOB and the rest of your insurance details might be very costly. To learn more about understanding your insurance benefits, check out our series on “Access to Diabetes Care”.