When Insurance Gets Turned Down: Appeals Explained

By Ava Runge, Lynn Kennedy, and Kelly Close

By Ava Runge, Lynn Kennedy, and Kelly Close

It can be extremely distressing if an insurance provider decides to deny coverage of treatment. Fortunately, there are options available for asking the insurance provider to reconsider their decision and for letting them know why they should – this process is called “appealing.”

Leer este artículo en español.

Editor's note: This article was updated on December 19, 2019.

[Please note that this article is targeted at people in the US with private insurance, although others may still find the information to be helpful. Do you have Medicare insurance? Check out our diaTribe article on appealing Medicare claim rejections.]

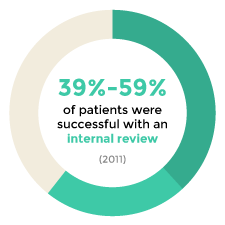

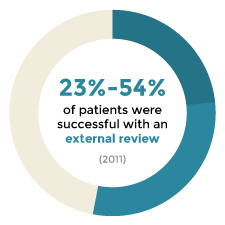

In fact, it’s often very worthwhile to appeal. A 2011 report sampling data from states across the US found that patients were successful 39-59% of the time when they appealed directly to the insurance provider (called an internal review), and 23-54% of the time when appealing through a third party (an external review) – the step taken when the internal review still doesn’t resolve the situation.

Despite this promising success rate, submitting an appeal can be a daunting task. The sections below aim to demystify the appeals process and provide an overview of why claims are denied and how they can be appealed.

In this article:

Click to jump to a particular section!

Have you filed an appeal? Tell diaTribe about your experience!

What is an Appeal?

Appealing means asking an insurance company to reconsider its decision to deny paying for a therapy or service. You have the right to appeal a denied claim up to six months after receiving the decision. [Editor’s Note: The US healthcare landscape is always changing, and diaTribe will be keeping a close eye on how any policy changes affect the accuracy of this article.]

It is important to note that the insurance company that denied coverage must state:

-

Why the claim was denied;

-

And how to dispute (or appeal) its decision.

There are two main types of appeals:

-

An internal appeal is when you ask your health insurance company directly to review of its decision to deny your claim.

-

In an external review, an independent third party (unaffiliated with the insurance company) will review your appeal and make a decision. People often turn to an external review if an internal appeal is not possible or is unsuccessful.

The appeals process is similar for people with Medicare coverage, although the wording is slightly different (e.g., an internal appeal is called a “redetermination”). A future diaTribe article will focus specifically on Medicare.

Why are Medical Claims Denied?

There are many common (and frustrating!) reasons why medical claims are denied. While it can be annoying and time-consuming to deal with, many denials can actually be resolved. The first step is understanding why a denial occurred in the first place.

Common reasons for a denial include:

-

Typos/misspellings in the original paperwork or data entry

-

The bill went to the wrong insurance company, often because the healthcare provider’s office had outdated insurance information on file

-

The treatment was determined to be “not medically necessary,” “experimental,” or “investigational”

-

The charge was for a service not covered by the health insurance policy (dental surgery, cosmetic surgery, and infertility treatments often fall into this category)

-

The treatment or service required (but did not have) a referral or pre-authorization from a physician

-

The provider was “out-of-network” (This applies to HMO and EPO plans – more information on these plans can be found in a diaTribe article here)

-

The person whose claim was denied was no longer enrolled or eligible to be enrolled in the health plan used for the claim

How to Submit an Internal Appeal to a Private Insurance Provider:

-

Determine what led to the denial in the first place. Contact the insurance provider.

Insurance providers will typically provide a reason in the Explanation of Benefits (EOB) document that accompanies a denial letter. If it isn’t clear from this document why the claim was denied, you can call the customer service number on your insurance card to ask for more information. In fact, many insurance providers state that the first step after receiving a denial letter is to contact one of their representatives (e.g., CareFirst lists this as their first step here). Do this. And if the insurance provider says to either call or submit a written appeal (like Aetna does), it is likely a good idea to call first. A discussion could resolve the situation before a formal appeal is even needed.

Make sure to take down the name and phone number of the customer service agent with whom you speak, as well as the call reference number. It may be helpful to have this information on hand later, especially if you get conflicting answers or explanations.

Make sure to take down the name and phone number of the customer service agent with whom you speak, as well as the call reference number. It may be helpful to have this information on hand later, especially if you get conflicting answers or explanations. -

Check for easy problems first.

Claims are often denied due to simple errors, such as a healthcare provider accidentally entering the wrong code, insurance ID number, or date of service on a claim form. Read through all the documentation from your insurance company, and let them know if you catch any errors. This can be resolved via phone, but other denials may require a lengthier appeals process.

.png) Google your insurance provider, your health plan, and your situation (e.g., being denied CGM coverage) to see if other people have already figured out how to successfully navigate it in circumstances similar to your own.

Google your insurance provider, your health plan, and your situation (e.g., being denied CGM coverage) to see if other people have already figured out how to successfully navigate it in circumstances similar to your own.

-

Ask for a “peer-to-peer” evaluation.

In a peer-to-peer evaluation, your healthcare provider will speak with another medical professional associated with the insurance company about why the service or therapies are medically necessary. These can sometimes clear up the denial without requiring an appeal. The insurance company may have a decision within 24 hours (but it’s helpful to check with them about their timeline if not). -

Plan your appeal.

If you still need to appeal the decision after completing steps 1-3, it’s time to strategize – and there are resources that can help. To have a compelling appeal, you will need to prove that the services or therapies you want covered are medically necessary and that they qualify for coverage under your plan’s benefits and rules. Take time to gather all of the evidence and resources you will need to mount the strongest appeal possible (keep in mind, however, that most plans only allow an appeal within six months from the date the claim was denied). Some appeals are handled by your healthcare provider’s office or hospital. In this situation, you’ll mostly just be overseeing a case manager who will complete steps 4-5 below. In other cases, you’ll be managing the appeals process yourself, or with resources like the Patient Advocate Foundation or your state’s Consumer Assistance Program. Collect the following evidence to strengthen your case:-

Letters, referrals, and prescription information from your healthcare provider to show the medical necessity of the drug, device, or service.

-

Any relevant information from your medical records.

-

Articles from peer-reviewed clinical journals that show medical efficacy or necessity. Try searching journals on PubMed.gov or Google Scholar. Some drug and device companies will also provide resources supporting use of their drug or equipment.

-

Find organizations and/or laws that support your claim – Does the Americans with Disabilities Act (ADA) offer information to support your case? Is there a state law that strengthens your claim? If so, make sure to cite these in your appeal letter as well.

-

.png) Assume the insurance provider will not ask you for more information to support your appeal if they find anything to be unclear. It is best to include any information you think could be relevant.

Assume the insurance provider will not ask you for more information to support your appeal if they find anything to be unclear. It is best to include any information you think could be relevant.

-

Complete and submit your appeal.

The paperwork required for an appeal differs by insurance company and plan. The EOB document you received should explain how to appeal the decision (make sure to call the insurance provider if you still have questions). Some insurance companies have standard appeals forms to complete that can speed up the process. Most of the time, however, you will want to write an appeal letter that tells the insurance company you disagree with their decision to deny coverage and provides evidence supporting your case. When writing your letter, make sure to keep the tone factual and respectful. Your letter should include the following information:-

Your information, including your name, policy number, group number, claim number, or anything else that would be needed to identify your case.

-

The insurance company’s reason for denying to cover the therapy or service.

-

A quick history of your diabetes, other relevant conditions, and treatment. Assume that the reviewer does not have familiarity with diabetes or diabetes therapies, so make sure to explain what your drugs or devices are and what they do.

-

Any corrections to information in the denial letter (if applicable).

-

Why you believe the insurance company’s decision was wrong and why the drug, device, or service is medically necessary. Draw on information in the Evidence of Coverage documents to show your claim is reasonable. Include evidence to support your case, such as research from peer-reviewed literature discussed above and your own medical data.

-

The complications that might occur if you cannot access the therapy or service. You can also use research here to support your argument.

-

Close by summarizing why the drug, device, or service is medically necessary for you, explaining what you would like the insurance company to do, and expressing gratitude for their consideration.

-

.png)

Keep detailed records of all communication with an insurance provider, including shipping receipts that prove they received your materials.

-

Follow up if needed.

After 30-60 days, you will receive a written decision from your insurance company. If the company denies your claim after internal review, don’t lose heart. There are still several options. Sometimes your plan will allow for another internal review, but after you have exhausted your insurance company’s internal review process, you can file for an external review with an independent third party.

.png) Set reminders on your phone or calendar to follow up with the insurance provider. They are more likely to move your claim through the process quickly if you stay involved and check in periodically.

Set reminders on your phone or calendar to follow up with the insurance provider. They are more likely to move your claim through the process quickly if you stay involved and check in periodically.

How to File for an External Review:

Your insurance company’s final determination letter denying your appeal must include information on how to file for an external review, as well as the timeframe in which you must make your request (often within 60 days). You typically can only file for an external review after completing the internal appeal process, but in medically urgent situations it can be possible to skip this step. Insurance companies in all states must participate in external review, but have varying processes.

An authorized representative may also file an external review on your behalf by submitting an Appointment of Representative Form. Note that while a healthcare provider may be able to serve as your authorized representative (though some insurance providers don't allow this), there may be disadvantages to a physician serving in this role – e.g., losing advantageous timelines or evidence submission benefits. A friend, relative, or attorney could also serve as your authorized representative.

Standard external reviews are typically decided no longer than 60 days after receiving the request. Once the external review makes a decision, your insurance company is legally required to accept it.

Resources to Learn More/Help with the Appeals Process:

-

The “How to appeal an insurance company decision” article on Healtcare.gov provides a good overview of the basics.

-

The Patient Advocate Foundation offers professional case management services to help with the appeals process. Check out their comprehensive guide to navigating appeals.

-

Your state’s Consumer Assistance Program or Department of Insurance may also help provide information and resources to assist with the appeals process.

-

This Wall Street Journal article summarizes some of the most common reasons claims are denied and what the key to successfully appealing is likely to be.

-

To see more information on appeals from experienced diabetes advocates, check out this great resource by DiabetesSisters.

-

This JDRF toolkit for healthcare providers has specific information about obtaining CGM coverage (including appeals) on pages 11 and 12.

.png)

See if the company that makes the diabetes drug or device has resources to support people appealing denied claims.

Sample Appeals Letters:

-

A Medtronic resource kit, including a sample appeal letter, for the 670G hybrid closed loop system

-

The Patient Advocate Foundation provides a couple examples of patient appeal letters in this document here, which also includes a sample appeal letter from a healthcare provider

-

An appeals letter about denied CGM coverage by diaTribe contributor Kerri Sparling

What’s Worked for Other People with Diabetes? Hear from Them!

-

I was denied my first CGM in 2008 by a Blue plan and fought and won by knowing how to Google my payer's medical policy and prove that I met coverage criteria. It helped that I was given the HCP line phone number by a nurse sympathetic to my cause, but I ended the call with an authorization code. – Melissa

-

My strategy has always been persistence pays (eventually the insurance company will give in, although they may have peculiarities to navigate. The doctor's office is really key and many have specialists who only deal with insurance company issues [mine does]). I've been covered by four insurance companies over the past decade while at the same employer if that tells you anything about the evolving insurance market. My experience with Anthem was a hassle but predictable, United Healthcare was easiest to navigate, Aetna was straightforward but a pain and had some weird rules (Why does a precertification inexplicably expire at the end of a calendar year? My chronic illness did not expire at the end of the year). – Scott

-

I was denied my first Dexcom last September by United Healthcare. I've not been denied anything under them for the eight years I have been insured by them so I was a bit shocked. With the guidance of my Byram Healthcare representative, I appealed it with a letter of medical necessity from my endocrinologist and it was overturned. – Jean

-

After a battle with Coventry Healthcare of Kansas, I received a phone call today telling me that my appeal had been approved and that I would be able to get coverage for a CGMS… My first claim for a 72-hr CGMS test was denied as experimental and the doctor seems to have simply assumed that I had type 2 diabetes based upon my age. – Scott

Let diaTribe know what’s worked for you, and we’ll update this page as we hear back!

This article is part of a series on access that was made possible by support from Lilly Diabetes. The diaTribe Foundation retains strict editorial independence for all content.

This article is part of a series on access that was made possible by support from Lilly Diabetes. The diaTribe Foundation retains strict editorial independence for all content.